Knowing the differences between interest rates and APR can save you money when taking out a car loan.

Unless you’ve got stacks of cash filling up your closet or stuffed under your mattress, you’ll likely need to finance a loan for a new or used car purchase or refinance an existing loan to save some extra cash. In fact, 85% of new vehicles — and 55% of used ones — are financed with a loan or lease, according to Experian.

Taking out a loan isn’t as easy as telling a bank the value of the car you’re looking to buy, however. A multitude of fees, charges, and other expenses muddle up the car-buying process and make it a bit more difficult and confusing to find the best loan for your new ride.

Though many factors can help you determine if a given loan’s worth taking out, two of the most important numbers you should look for are the interest rate and annual percentage rate, or APR.

Interest rates and APR aren’t synonyms. They vary both in definition and use. Understanding the differences between interest rates vs. APR on a car loan can help you make a wiser purchasing decision when it comes time to replace that junker in your garage (or simply upgrade to leather seats and two cup holders).

How Car Loans are Financed

Financing a car loan is a little more complicated than telling a bank how much you need to borrow, receiving that money, handing it to a dealership, then paying a monthly bill — at least at first.

In essence, there are multiple components that, added together, constitute what goes into your loan and how much debt you’re on the hook to repay.

The first and biggest chunk of a car loan is the principal, the money you borrowed and agreed to pay back in order to purchase the vehicle. For example, purchasing a car for $28,000 means the loan principal balance is $28,000. You can reduce the principal by paying a down payment or trading in your existing vehicle (the value of which would be deducted from the principal).

Principal: the money that you originally agreed to pay back, typically the purchase price of a car plus any other extras financed.

Interest: the amount you pay to borrow money; it’s a percentage, such as 4.5%.

APR: the annual percentage rate (APR) is the entire amount you pay to borrow the money, including interest and fees.

The interest is the amount of money you’ll pay on top of the principal in exchange for taking out the loan. Since you’re effectively buying a product by taking out a loan, interest is how lenders earn a profit and stay in business.

Car loan interest is amortized, or front-loaded. As a result, the bulk of your early payments goes toward paying down your loan’s interest, with the remainder being applied to the principal. As you pay your loan over time, more of your payment will be shifted to pay down the principal until the loan is fully paid off.

Your car loan may also include certain fees and charges that stem from buying a car, such as:

- Prepaid finance charges (the lender’s compensation for giving you a loan);

- Origination fees;

- Sales tax and registration fees;

- Extended warranties and service contracts; and/or

- Guaranteed Asset Protection.

Rolling fees and charges into your loan can add $2,000 to $3,000 to the amount you’re borrowing. You may, however, choose to pay for these costs upfront and out-of-pocket to save yourself from the additional interest they’d accumulate if they were rolled into your loan.

What is a Car Loan’s Interest Rate?

The interest rate, or note rate, of a car loan is the annual cost of borrowing money. Interest rates are calculated on the principal of a loan. A lower interest rate means you’ll pay less money over the life of your loan. A higher interest rate means your loan is more expensive.

The interest accrued on a car loan is considered simple interest, not compound interest. Simple interest is calculated as a flat percentage of what you’re borrowing, so it doesn’t grow over time, even as you pay it down. On the other hand, compound interest builds upon itself over time, as is the case with some student loans, effectively making you pay interest on your loan’s interest.

What is a Car Loan’s APR?

The APR of a car loan reflects the total cost of taking out a car loan. An APR provides you a broad overview of all the bells and whistles you may have rolled into the loan, such as the:

- Principal amount you’re borrowing;

- Interest you’ll pay on the principal;

- Other fees and charges associated with taking out the loan; and

- Anything else you rolled into the loan, such as sales tax, registration fees, and extended warranties.

As with interest rates, a higher APR means you’ll pay more money over the course of a loan’s term compared to taking out a loan with a lower APR.

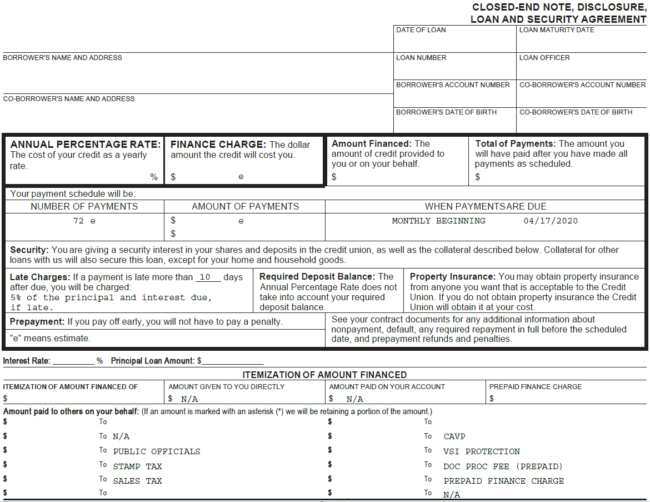

The Federal Truth-in-Lending Act, or TILA, requires all lenders to provide consumers with a loan’s APR. This makes it easier for you to compare rates between lenders to find the best and most affordable loan for you.

Sample Truth-in-Lending Disclosure for a car refinance loan

Difference Between the Interest Rate and APR of an Auto Loan

The interest rate of a car loan tells you the cost of borrowing the loan principal. If you’re trying to finance the purchase of a $20,000 car, your loan’s interest rate will only apply to the base purchase price — the total actual value of the car, minus any down payment or trade-in value.

APR builds upon the information given to you by the interest rate. Because your loan is likely to include more than just the worth of the car you’re buying, it makes sense for the APR to be based on the total cost of taking out the loan.

The APR of a car loan will almost always be a higher number than the interest rate alone because it takes into account the additional expenses of a car loan. However, in some cases, a loan’s APR may be lower than its interest rate if a lender is offering a special incentive or rebate.

Comparing interest rate vs. APR

| Interest rate |

APR |

| Based on a loan’s principal |

Based on a loan’s principal and interest rate, plus any other fees and expenses wrapped into the loan |

| Reflects the cost of borrowing money |

Reflects the broader cost of taking out a loan |

| (Almost always) lower than APR |

Usually higher than a loan’s interest rate, except in certain scenarios |

Interest Rate vs. APR: Which Matters Most for a Car Loan?

When shopping around for and comparing car loans, it’s helpful to consider both the interest rate and APR of any given loan. Looking at the interest rate tells you how much you’ll have to pay to borrow the principal of the loan itself, and is a major component of determining the loan’s APR.

Since the fees and additional charges of a loan may differ from lender to lender — even if the principal, interest rate, and loan term stay the same — it’s easier to compare loan APRs instead of interest rates. By including the interest rate and all the other expenses of getting a loan, the APR is the best metric you have for deciding how much a given loan is going to cost you over its term.

How Do I Calculate My APR?

Car loan APRs must be provided by the lending institution per federal law, but there are cases where you may or need to calculate it yourself. Bear in mind that determining your APR yourself isn’t an exact science, so you may be slightly off from the APR provided by your lender.

Fortunately, there are a handful of formulas for estimating your loan’s APR. To estimate your APR:

How to estimate your car loan APR

- Add your loan’s total interest and fees together (I)

- Divide that number by the loan principal (P)

- Divide that number by the number of days in the loan’s term (T)

- Multiply by 365

- Multiply by 100

Estimated APR = [(I/P/T) x 365] x 100

The solution to the equation should be close to the true APR of your loan.

Car Loan APR Calculator

For example, assume you have a 48-month loan term (1460 days) for a loan with a principal amount of $38,000 and $5,000 of interest and fees. When estimating your APR, you’d calculate:

[(5000/ 38000/1460) x 365] x 100 = 3.29% APR

Certain lenders may also provide proprietary loan calculators in which you can input your loan’s amount, term, interest rate, and other information to estimate its APR. Again, most calculators have some degree of a margin of error, so the APR may not be exact, but is likely to be close to the target.

How to Get a Good Rate

When you’re in the market for a shiny new something, it’s always wise to shop around to find the best deal. The same concept applies to financing a new car purchase. Comparing loans from different lenders can save you heaps of cash (and let’s face it — we’d all rather spend our money on something fun instead of a car payment, no matter how cool the car is).

One of the most important factors that influences whether or not you’ll qualify for a good APR is your credit history. At the start of your car-buying process, consult your credit report to make sure it’s in as good a shape as possible. The better your credit, the lower your interest rate and APR, meaning you’ll fork over less cash over the term of a car loan.

Next, start looking around for lenders that will pre-approve you for a car loan. Oftentimes, a bank or credit union will offer more favorable terms than those offered by a car dealer. Better yet, arriving at a dealer with a pre-approved loan offer gives you leverage to potentially negotiate even more favorable financing terms.

Your loan term also influences its APR. A longer loan term may reduce your monthly payment, but increase its APR and how much interest you’ll pay over time.

Another factor that influences the favorability of a loan’s APR is your loan-to-value ratio, or LTV ratio. The LTV ratio is the size of your loan divided by the actual value of the vehicle you’re buying. A loan is considered “upside down” if it exceeds the actual value of the collateral — in this case, the car you’re buying.

You can reduce your LTV by putting a down payment on a vehicle and reducing how many expenses are rolled into the loan. In general, the lower your LTV, the lower your loan’s APR.

Finally, check to see if your lender is offering any incentives or waiving any fees that would otherwise be included in your loan. If they’re happy to waive the origination fee, for example, that’s less money you have to pay back, thereby reducing your APR.

How to determine if you’re getting a good rate

There are a lot of numbers involved with buying a new car, and your loan’s APR is just one of them. Getting a good APR, however, means that you’re not giving up any more of your hard-earned cash than you need to.

But how do you determine if you’re getting a good APR?

When you’re comparing loan offers from two or more different lenders, pay special attention that you’re comparing apples-to-apples — APR to APR, not APR to interest rate. Auto loans aren’t as regulated as mortgages and some other types of loans, so you may have to do some digging through paperwork to find the APR of a given loan.

Make sure, too, that you’re comparing APRs based on the same loan term. The APR of a 36-month loan, for instance, is going to be less than that of a 48-month term. If, however, a 36-month term is out of your budget, it doesn’t matter what that offer’s APR is.

The Bottom Line: An Auto Loan’s APR Is More Important than Its Interest Rate

There’s nothing wrong with knowing as much about your car loan as is humanly possible. Your bank balance will reflect how well-informed you are about any purchase you make, and buying a new or used car certainly isn’t the time to skimp on details.

When comparing different loan offers from banks, lenders, and dealers, pay special attention to the APR of each. Though it helps to glance at the interest rate, too, the APR reigns supreme when it comes to choosing a loan that will make the most financially-viable decision for you and keep more of your hard-earned money in your pocket.

;)