Bad credit doesn’t guarantee a bad financial future. It just means that you have some work to do!

Bad credit happens to the very best of us. Afterall, it’s easy to get behind on bills, splurge too often on credit cards, and simply just take on more credit than you can manage.

But bad credit doesn’t have to be forever. There are a few, relatively simple, money moves you can make to start raising your score.

What Is a Bad Credit Score?

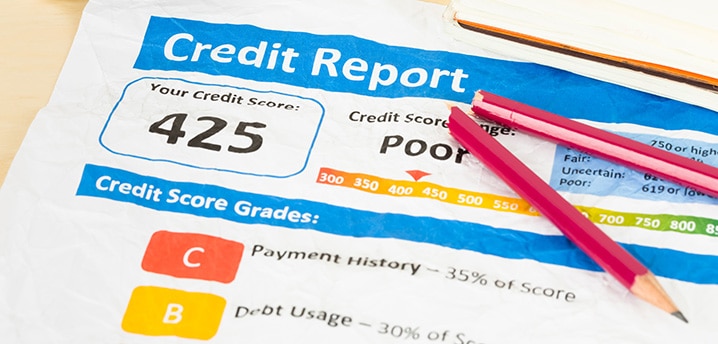

What is and isn’t considered a bad credit score depends on the type of credit scoring model that you are pulling your score from. There are two different scoring models that are commonly used: FICO® and VantageScore.

Although FICO® scores are by far more popular with lenders, VantageScore was created by the three major credit bureaus (Equifax, TransUnion, and Experian) as an alternative.

Both of these scoring systems have multiple different versions of credit scores, each with a slightly different algorithm for determining your score.

Here is how FICO® rates each score:

- Exceptional credit: 800+

- Very good credit: 740-799

- Good credit: 670-739

- Fair credit: 580-669

- Poor credit: Below 580

If you are pulling your VantageScore, the score ranges vary slightly from that of FICO® scores:

- Excellent credit: 781 to 850

- Good credit: 661 to 780

- Fair credit: 601 to 660

- Poor credit (bad credit): 500 to 600

- Very poor credit (very bad credit): 300 to 499

In both cases, poor credit means bad credit.

What Makes Up a Credit Score?

Since credit scores are meant to reflect your worthiness as a borrower, they take into account quite a few of your financial habits.

- Payment history: Your payment history is such a large factor in calculating your score because creditors want to know that they can trust you to pay back your debt. Included in payment history is whether or not your past payments were made on-time, if you have defaulted on a loan, and if you have any credit accounts that have been sent to collections.

- Amounts owed: The outstanding amount that you owe to creditors is a key piece of your credit score. Creditors want to see that you are able to use the money that you lend to them responsibly and a high credit-utilization ratio can send them the opposite message.

- Length of credit history: How long you have had credit lines open helps FICO® determine your track record. The more experience that you have responsibly handling your debt, the better.

- Your credit mix: When it comes to your credit mix, having one type of credit line isn’t always enough. Instead, borrowers should aim to have multiple different types of credit lines (i.e. credit cards and auto loans) so that they can show creditors that they can handle multiple kinds of debt.

- How many inquiries you have: If your credit is pulled often, it shows creditors that you frequently take on more debt, which could mean that you are not financially fit for a new line of credit. That said, hard pulls that happen during periods of “rate shopping” (for things like auto loans, home loans, and student loans) will only have the effect of one pull.

Why Do I Have Different Credit Scores?

Simply put, your credit score is different depending on where you look because each scoring system weighs out the factors that impact your score a little differently.

The charts below compare the scoring systems between FICO® and VantageScore. For example, you’ll notice that payment history accounts for 40% of your VantageScore credit score versus 35% for FICO®.

How Do You Get Bad Credit?

A poor credit score isn’t something that typically just happens overnight. If you have it, the reality is that you may have borrowing habits that aren’t very healthy. These might include:

- Not paying bills on time

- Letting bills get sent to collections

- Using too much credit

- Letting your credit get pulled too often

- Letting long periods of time pass between using credit

Bad credit vs. no credit

That said, there is a difference between having bad credit and having no credit.

If you have never taken out a loan or used a credit card, there is a good chance that your bad credit is due to you simply just not having anything in your account. If this is you, getting a starter credit card can be a great way to start building your credit.

How a Bad Credit Score Can Affect Your Credit Options

It’s easy to get caught up on the word “bad” when your score falls into the lower credit score range. However, it doesn’t mean that all lenders will consider you to be a bad borrower. That being said, when you go to apply for loans, you’ll run into two major issues if you have bad credit:

Limited lender options

Those with bad credit will likely find themselves with less credit options to choose from than those with higher scores. Typically, if you have a poor score, you’ll find that less lenders are willing to work with you, and you’ll have fewer credit types available (auto loan, credit card, mortgage, personal loan, etc.).

Less favorable terms

Typically, borrowers with less than stellar credit have less favorable terms than their high-credit score counterparts. Over the life of a loan, this can cause them to pay more money for the same loan amount.

This is exactly why it’s so important to shop around and to never take the first loan that is offered to you. You want to weigh out all of your options before making a decision in order to get the best terms.

Borrowers should compare:

- Interest rates

- Down payment requirements

- Credit limit or loan disbursement amount

- Origination fees

- Loan term

How to Repair Bad Credit

The reality is, you can’t fix bad credit overnight. Instead, you will need to make a game plan and stick to it in order to reach a good credit score. It’s important to remember that consistency is key!

To ensure that your plan pays off, make sure to consider taking the following steps.

1. Check your credit report

Knowing where you are starting from is the only way that you are going to be able to measure the success of your efforts to improve your score. This is why it’s so important to check your credit once a year, even if the thought of seeing your report gives you the heebie jeebies.

Luckily, checking your credit is easy to do with sites like AnnualCreditReport.com. In fact, all Americans are entitled to one credit report from each of the major credit bureaus once per year.

It’s important to note that your credit score and credit report are two different things. When you pull your credit report, you won’t receive a score. Instead, you will see the factors that make up your score, like your payment history and current debt balance.

2. Dispute any incorrect information

If you pull your credit report and see incorrect information, like a credit line that you never opened or an overdue balance that you know you paid, you will want to dispute these with each credit bureau that is reporting them. This could be a huge factor impacting your creditworthiness.

To dispute these errors, you will either need to send a letter to each respective bureau, give them a call, or file a report through their online portals.

3. Open a new credit line

If you don’t have an open credit line, it’s likely that this is impacting your score.

Although not opening a credit line might seem like the right thing to do when your credit is already bad, it’s important to show creditors that you can manage your debt. Instead of writing off credit, consider applying for a secured credit card that is designed to help you repair bad credit.

4. Refinance high-rate loans

It might seem counterintuitive to refinance a loan and take another hard pull to your score, but hear me out.

Although refinancing will dip your score by about 5 points or so (as hard credit inquiries often do) if you’re applying with a better score than you had when taking out the original loan, you still stand a chance at securing a lower rate and a longer repayment schedule.

To give you an example, let’s say you took out a high-interest auto loan with a dealership because your credit wasn’t so great at the time. These predatory loans can cost borrowers majorly. However, if you’ve been making on-time payments on your car loan, that positive payment history helps your credit score improve — and can even help you move up a credit tier and qualify for better rates than when you first took out the loan.

Refinancing your auto loan at a lower rate could also knock off a sizable portion of your monthly payment. Last year, borrowers who refinanced their auto loans saved about $97 per month. That’s now extra money you can put towards other goals, like paying off other debt.

5. Making on time payments

Making on time payments is an important step to improving your credit. If you have a history of not doing so, this might just be the reason that your credit is poor.

Remember, lenders like consistency, not inaction! Even if you can’t afford to pay the full amount of your debt, setting up a payment plan with smaller, more manageable payments, can help you transform your score.

6. Lower your credit utilization

It’s easy to charge everything on your credit card and worry about it later, but if you are, you could be doing a disservice to your credit. Experian recommends that you keep your credit utilization low, specifically in the single digits, to keep your credit score healthy.

If you find yourself maxing out your credit card often, it might be time to ask your lender for a credit line increase. Before you do, however, make sure that the increase won’t further tempt you to spend. After all, accumulating too much credit card debt can be dangerous even if it doesn’t damage your credit score.

7. Avoid hard credit pulls

Multiple hard credit pulls in a short period of time can raise red flags to creditors, which means that it will negatively impact your score. This is because borrowers who open credit lines often are considered more risky to lenders due to their, apparent, increased need for credit.

To best avoid this, borrowers should make it a point to stretch out the length of time before applications that might require a credit check, as long as they are not rate shopping.

8. Don’t close credit lines

When you are done paying down a credit line, it might be tempting to close it and be done with it. If you are trying to fix your credit, however, doing so could set you back.

When you close a credit line, like a credit card, you are lessening your available credit. Doing so can cause your credit utilization to rise, especially if you have a substantial amount of other debt.

Additionally, the length of your credit history is a small, but important, factor in your overall credit score. Closing a long standing credit line could reflect negatively on your score.

Building Credit Is a Long Game, Not a Race!

Like many things in life, especially personal finance, the best way to get what you want is to practice patience. Repairing your credit is no different.

Improving your score won’t happen overnight, especially if you have many credit lines that have fallen by the wayside. Instead, you’ll need to consistently work on building your score by improving your standing with creditors, paying off your debt, and using your credit lines appropriately.

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)