RateGenius data confirms auto loan refinancing approvals have increased 66% since May 2020, in part due to the rise in vehicle values and their positive impact on loan-to-value ratios.

Last month, as the Manheim Used Vehicle Value Index reached a new all-time high and used car values soared, an important auto refinance loan factor descended into a new low — a positive one for consumers. Suddenly, auto loan refinancing approval odds improved for all borrowers across the U.S., all because of a lesser-known factor called loan to value.

Current used car values aren’t just good news for those wanting to sell or trade-in their wheels. Vehicle values are one part of the loan-to-value ratio (LTV) calculation. Because used car values have gone up, LTVs are down, and more borrowers are now more likely to get approved for auto loan refinancing without having to do a thing.

In fact, in our analysis of retail loan-to-value ratios, we found that in May 2021, not only were LTVs the lowest we’ve seen, but auto refinance approvals increased by 66% compared to the year before.

This is great news for borrowers who may not have been able to get approved for auto loan refinancing just a few months ago. This boost can put you well within the lending institution’s LTV guidelines. It also means borrowers with strong applications (great credit, stable income, low debt, etc.) may get even better loan terms.

📌Loan-to-value ratio: also known as LTV, a percentage indicating whether your vehicle is worth more or less than the balance on your auto loan. The maximum LTV for auto loan refinancing is generally between 125% and 135%, depending on the lender, your credit, and other factors.

Learn more about loan-to-value ratios.

We analyzed thousands of anonymized, completed applications in the RateGenius database to get a closer look at the impact of record-high used car values on retail loan-to-value ratios and auto refinance loan approvals.

Key Findings

Editor’s Note: The report was updated on July 14, 2021 with June 2021 auto refinance data. Updated sections are highlighted below.

Used Car Values

- Among popular vehicle make and models refinanced in the RateGenius network, the 2017 Ford F-150 pickup increased in value by $10,475 (+40%) from May 2020 to May 2021.

- The next greatest percentage increase was the 2017 Nissan Rogue. The SUV’s value increased by $3,775 (+30%).

- The 2017 Honda Civic sedan value increased by $3,800 (+28%), followed by the 2017 Jeep Wrangler which had the second-highest average gain in value, $6,325, but the smallest overall increase (+25%).

Loan-to-Value Ratios

- The average retail loan-to-value ratio across all auto refinance applications in May 2021 was 102%, the lowest on record (at the time this report was published).

- Last month, the average retail LTV was 26% lower than January 2020, 18% lower than January 2021, and 27% lower than May 2020.

- June 2021 had the lowest retail loan-to-value ratio on record for all auto refinance applicants, an average of 97%.

Auto Refinance Approvals

- One-third of all applicants (32.9%) were approved for auto loan refinancing last month, the highest approval rate on record (at the time this report was published).

- In May 2021, auto refinance loan approvals increased 37% versus January 2020, 14% compared to January 2021, and 66% than in May 2020.

- June 2021 had the highest loan approval rate on record. 38% of applicants were approved for an auto loan refinancing in the RateGenius lender network.

📉Skip ahead: June 2021 retail loan-to-value ratios vs. auto refinance loan approvals

Why Are Used Car Values at an All-Time High?

The way things normally have worked, vehicle values typically go down as time goes on. Cars depreciate. But thanks to the current market conditions, used car values have gone up thousands of dollars over the last year.

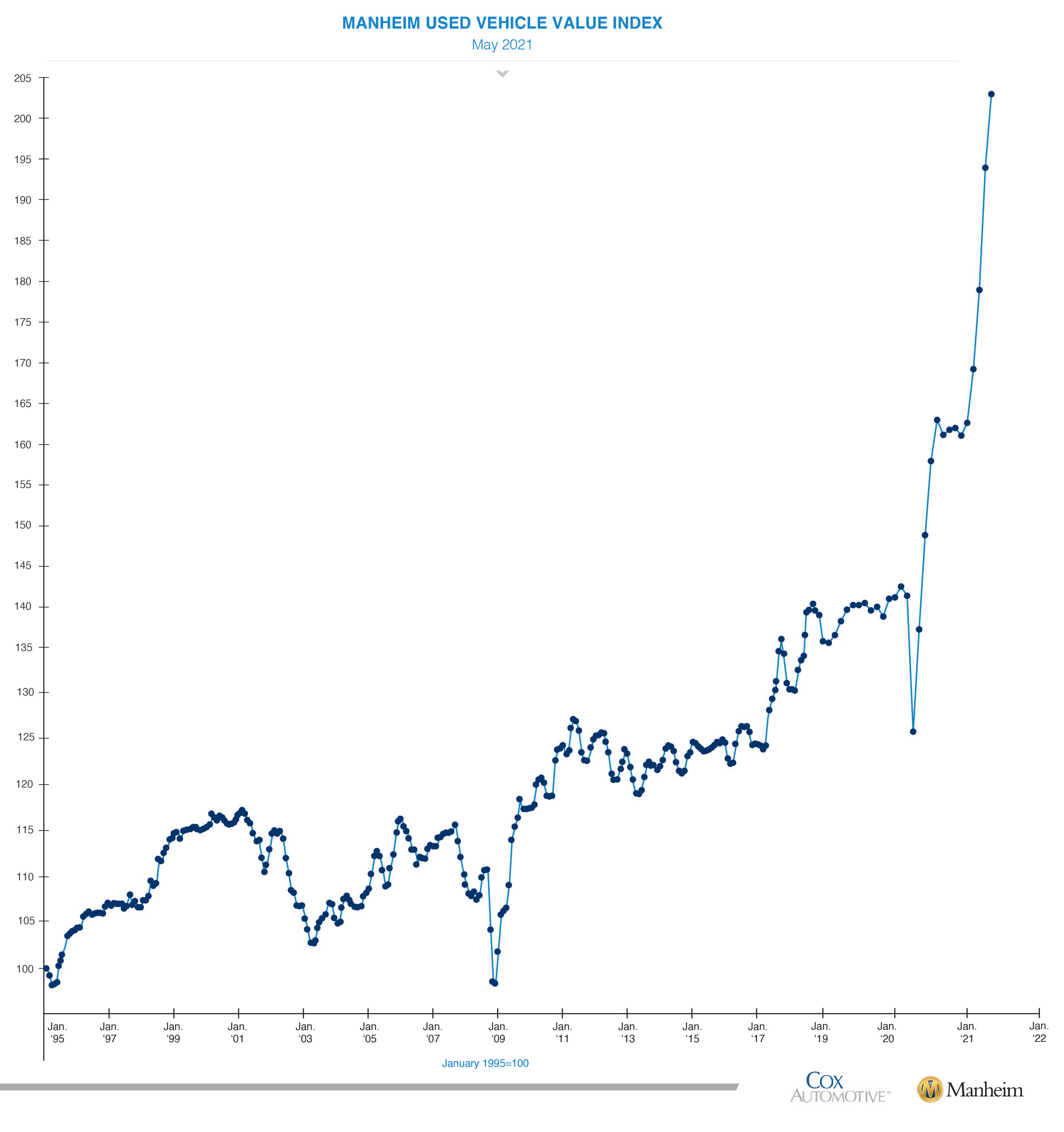

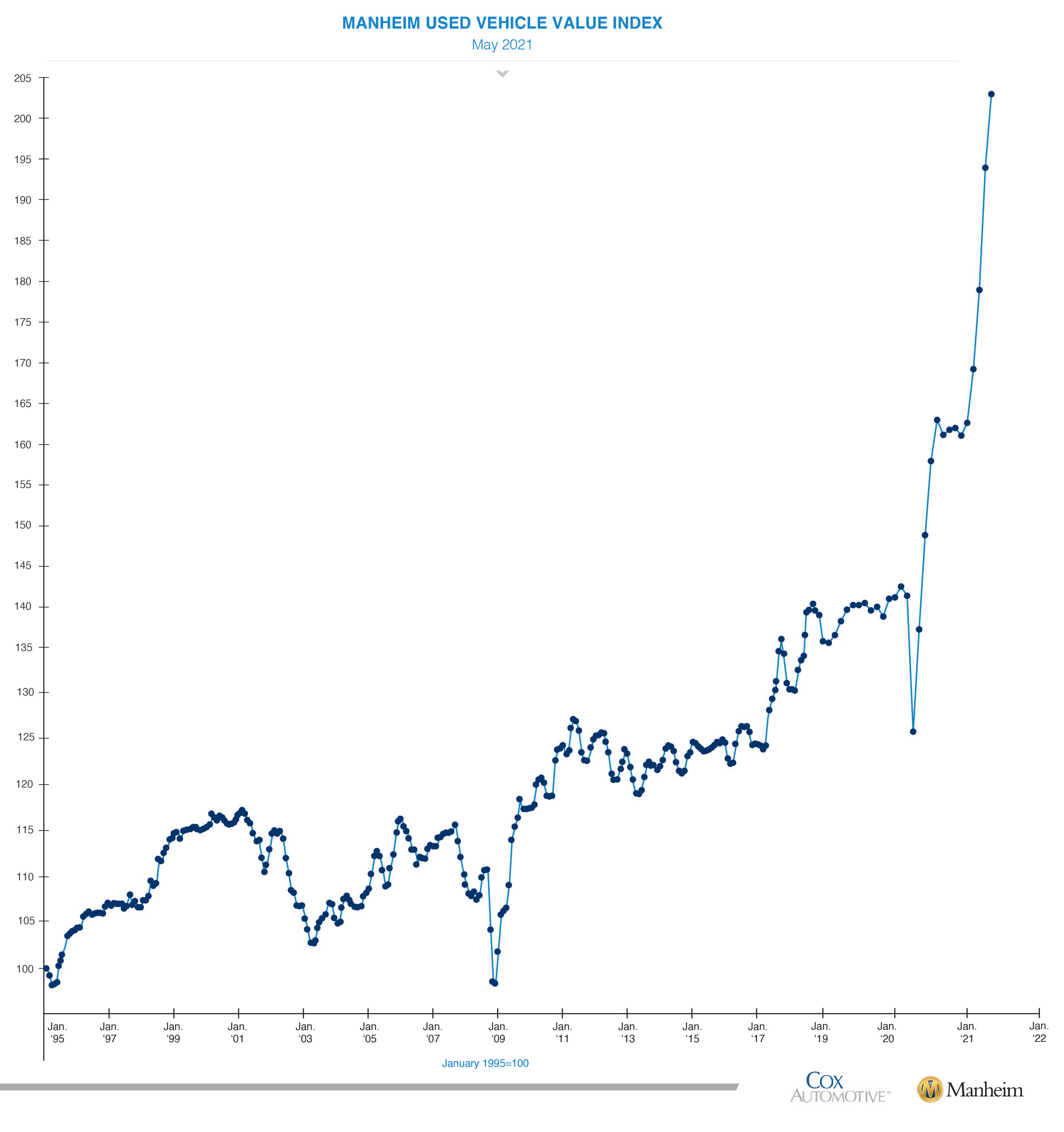

The Manheim Used Vehicle Value Index is a measurement based on an analysis of millions of used vehicle transactions annually and is considered the indicator of pricing trends in the market. In May 2021, the index reached 203 — a nearly 50% increase from one year ago and a new record high after several consecutive months of record highs.

There are several reasons for this jump in used vehicle values, but two stand out.

#1) The semiconductor microchip shortage has halted new car production

When the Covid-19 pandemic shut down factories last year and new car sales dropped, automakers canceled semiconductor microchip orders not anticipating demand. Well, there’s demand. A lot of it. As a result, Ford and General Motors have had to take hundreds of thousands of vehicles out of production. Honda, Nissan, Subaru, Toyota, and Volkswagen were also impacted, though not as severely.

An Edmunds report found that new car inventory was down 48% in April compared to last year. Broken down by class, truck inventory was down 64% while SUV and car inventory were down 44% and 42% respectively.

#2) Used car inventory is also low

It’s not just fewer new cars available on dealership lots, used vehicles are harder to come by too.

“Dealers have been scrambling to keep used vehicles in stock since May 2020, anticipating new inventory shortages, which really began to impact them by early summer of 2020,” explains RateGenius Co-founder and Chief Revenue Officer Chris Brown.

Even car rental companies are buying used cars to build their fleet. “Avis slashed inventory by as much as 28% by the end of 2020,” adds Brown. “With consumers wary of public transportation during the pandemic, those rental vehicles were sold quickly. Now the rental car companies are also scrambling to fill the need as people return to travel, and due to new vehicle production delays, they’re buying used vehicles as fast as they can find them.”

According to Consumer Reports, new vehicle production could be impacted until the fall, so the demand for used cars could remain high until new cars are available again.

Used Vehicle Value Comparison May 2020 vs. May 2021

To compare just how much used vehicle values have changed over the past year, we pulled retail values for four of the most popular vehicles refinanced in the RateGenius network — Honda Civic, Nissan Rogue, Jeep Wrangler, and Ford F-150 — and compared year over year. Each make and model were grouped with other like-vehicles according to model year, trim, and rounded mileage.

The biggest winner is the 2017 Ford F-150 with a 40% increase in value from May 2020 to May 2021. The average retail value increased from $26,275 to $36,750, a $10,475 gain in value in one year.

While that’s unheard of, it’s also not surprising. The Ford F-series is estimated to have the greatest production volume impact due to the chip shortage. There will be about 110,000 fewer new Ford trucks in production at least this summer and potentially even more through the fall.

The next biggest increase in value was the Nissan Rogue (+30% YOY), with the Honda Civic sedan (+28%) not far behind. Both appreciated about $3,800 over the last year. The Jeep Wrangler’s value climbed 25% ($6,325) during the same period.

Used Car Values’ Impact on Loan-to-Value Ratios in Auto Loan Refinancing

Knowing just how much some vehicles’ values have risen, it’s time to take a closer look at loan-to-value ratios.

Remember: A lower LTV is better because it means you have more equity. Since your car is the collateral that secures your auto loan, the higher value of your car helps offset some of the risk lenders take on when extending credit to a borrower.

In other words, you want your vehicle’s value to be as close to, or higher, than what you owe on your loan. Better approval odds for auto loan refinancing, and maybe better interest rates too.

In May 2021, average retail loan-to-value ratios fell to record lows. Applicants had a 102% LTV; borrowers had an 88% LTV.

Among all auto refinance loan applicants in the RateGenius database, the average retail LTV in May 2021 was 26% lower compared to January 2020 and 18% lower than in January 2021.

For borrowers who successfully completed the auto refinance process and funded (closed) their loans, the average retail LTV was 18% lower versus January 2020 and 11% compared to January 2021.

This decline is a positive trend for anyone who is hoping to get approved for auto loan refinancing.

Example: How Loan-to-Value Ratios Typically Work vs. 2021

As borrowers make payments on their auto loans, vehicles usually depreciate, about 15% every year. However, what’s happened to car values (and LTVs) in the last year is rare and extraordinary.

Let’s walk through an example of how loan-to-value ratios have improved over the last year.

Let’s say you had an auto loan balance of $25,000, and your vehicle was worth $20,000 last year. That makes your loan-to-value ratio 125%.

LTV calculation: 25,000 loan balance ÷ 20,000 car value x 100 = 125% (or use the LTV calculator below)

Car (LTV) Loan-to-Value Calculator

A loan-to-value ratio over 100% means you owe more on your loan than your vehicle is worth. An LTV over 125% can make it harder, but not impossible, to qualify for a refinance loan.

If your LTV is less than 100%, your car's value is higher than what you owe on your loan. The lower your LTV, the better.

Over the last 12 months you’ve made payments on the loan, so now your car loan balance has dropped to $20,000. If your car’s value were to stay the same, your LTV would be 100% because your vehicle’s worth is now equal to the amount left on the auto loan.

LTV calculation: 20,000 loan balance ÷ 20,000 car value x 100 = 100%

However, in a typical year, your car’s value drops because of depreciation. One year later, your vehicle’s value dropped from $20,000 to $18,500. Your LTV is now 108% which is still a strong number for auto loan refinancing purposes.

LTV calculation: 20,000 loan balance ÷ 18,500 car value x 100 = 108%

But, there was nothing typical about 2020. With car values rising as much as they did, your LTV is now much lower without having to do anything different.

With an increase of $4,500 on your vehicle’s value from May 2020 to last month, your LTV is now 82% — and you didn’t even have to make extra payments on your loan or do anything at all.

LTV calculation: 20,000 loan balance ÷ 24,500 car value x 100 = 82%

With an LTV below 100%, this means you now have positive equity which you can use to trade in or sell your car, or apply to refinance your auto loan to get a lower rate and better terms.

Used Car Values’ Impact on Auto Loan Refinancing Approvals

Borrowers have been benefiting from lower loan-to-value ratios over the last year.

In May 2021, borrowers were 66% more likely to be approved for an auto refinance loan compared to one year prior. Their odds of approval also improved by 14% compared to January 2021 and 37% when compared to January 2020.

7/14/2021 Update: We reviewed June 2021 data and found used car values had an even greater impact on

vehicle bookouts and auto refinance approvals.

- The approval rate reached a new all-time high of 38%, meaning more than one-third of all applicants were approved for auto loan refinancing.

- Retail loan-to-value ratios also reached a new all-time low at 97% on average across all applicants, not just approved borrowers.

3 Tips to Save Even More Money on Your Car Loan

Low interest rates and high car values are perfectly aligned to offer savvy borrowers even more savings when refinancing their auto loans.

In our analysis of May 2021 auto refinance data, we found the average savings from auto loan refinancing reached $98 per month for all borrowers across all credit ranges, the highest so far this year. Borrowers with credit scores below 700 knocked off an average of over $100 per month on their car payments.

If you’re ready to get a better auto loan, here are three tips to help you find the best refinance offer.

Tip #1: Calculate your LTV

If your loan-to-value ratio is too high, it doesn’t really matter what your credit score, income, or other factors look like. General rule of thumb is to aim for an LTV around 125%, with some wiggle room if your credit is super great.

To check your LTV, you’ll need your auto loan payoff balance and vehicle value. Sites like Edmunds, KBB, NADAguides, CARFAX, and others can help you figure out your car’s value. Find your auto loan balance on your lender’s website or latest statement.

Tip #2: Check your credit

When was the last time you checked your credit score or disputed incorrect information on your report? You can check your credit report for free on websites like Credit Karma and Credit Sesame, and you’re entitled to your free credit reports from all three major credit bureaus on AnnualCreditReport.com.

Once you know when your credit stands, you can look up current auto refinance rates to get an idea of what type of loan offers to expect — before submitting an application.

Tip #3: Shop for rates with multiple lenders

You can get pre-qualified without a credit check but to get an approval with real interest rates you will need that hard credit inquiry. Fortunately, rate shopping with multiple lenders won’t hurt your credit score.

Here’s how it works: Credit scoring models, such as FICO and VantageScore, will count multiple credit inquiries as one, but only if they’re for the same type of credit product (auto loans, student loans, mortgages) for a specified time period. FICO’s rate shopping window is 30 to 45 days while VantageScore’s is 14 days.

This means you can shop for auto loan refinancing rates with multiple lenders within a two-week period, and your credit score will not get penalized for every application submitted.

Pro tip: Use a loan marketplace (like RateGenius) to have your auto refinance application sent to multiple lenders at once. If approved — and chances are looking good — you can choose the best loan offer for you and your wallet.

Tip #4: Refinance sooner than later

Although experts expect used car values to remain high through the summer, the truth is, nothing is certain.

“It’s difficult to predict how long the current semiconductor chip shortage and low new vehicle supply will last, so we encourage consumers to maximize this opportunity to refinance and optimize savings on their auto loan,” advises RateGenius CEO Christopher Speltz. “Consumers should take advantage of this market sooner rather than later and refinance their auto loan while conditions are still so favorable.”

Methodology

RateGenius analyzed data on customer applications for auto loan refinancing made between January 1, 2019 to May 31, 2021. This dataset included thousands of anonymized completed auto loan refinance applications across all 50 states, credit scores, and loan terms. We examined loan approvals, auto loan debt, and vehicle values broken down by make, model, and class. For more information, email us at editor@rategenius.com.

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)