Money problems can play a huge role in marital dissatisfaction. Refinancing your auto loan is a great way to save money and avoid financial stress at the same time.

There are a few things that married couples are notorious for fighting over: whether someone forgot to take out the trash, whose turn it is to get up with the baby, which one of you needs to make dinner. Arguments over personal finances fall pretty high on that list, too. In fact, fights about money are a common thread in almost all marriages, regardless of age, location, or social status.

One of the best ways to reduce money-related arguments is relieve some of the financial stress in your home. This can be accomplished by financial planning, implementing a healthy budget, reducing expenses, limiting credit card debt, and agreeing upon your future goals as a couple.

Of course, a move like refinancing your auto loan won’t help solve those trash day marital disputes. However, it can work wonders for easing the financial strain in your home and, as a result, can seriously improve the quality of your marriage.

Money Issues are THE Leading Cause of Marital Conflict

We’ve all heard the question posed, Would you rather marry for love or for money? While the question implies that love and money don’t mix, this couldn’t be further from the truth. In fact, money is not only a focus in every household, it’s also one of the biggest points of contention for married couples today.

We’ve seen countless surveys conducted over the years, showing that a couple’s finances is the biggest cause of conflict in the relationship. This holds true across all demographics, too: We find that money is the root of most problems regardless of how much the couple earns, where they live, whether or not they have children, their ages, etc.

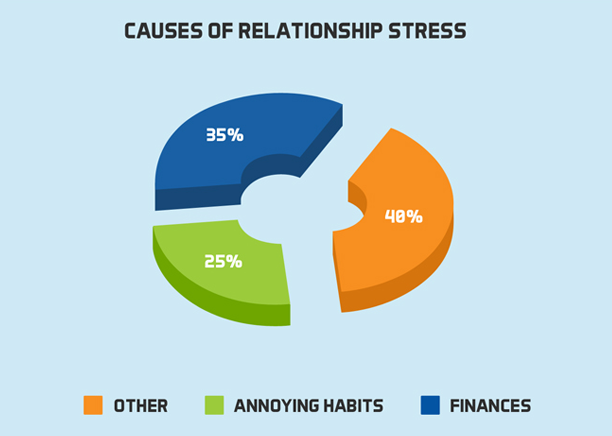

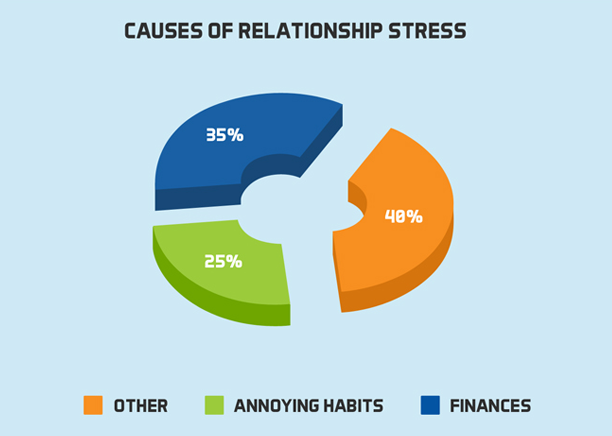

For example, a recent survey conducted by SunTrust found that among couples who reported having any sort of relationship conflict, 35% blamed it on money arguments. The next-highest cause — annoying habits — was a distant second with only 25% of the blame.

It’s not just fighting, either. According to the Institute for Divorce Financial Analysis, money issues were considered the cause of divorce in as many as 22% of couples.

So, why do so many couples fight over money anyway? Answer that question, and you’ll also discover how to fix it at the source.

Figuring Out the Root Cause of Money Problems

In order to resolve some of the financial problems in your marriage, you’ll need to hone in on why you’re fighting in the first place.

Some couples fight because they clash in their financial decisions. If you’re a saver and your spouse is a spender, for example, you might often disagree. Or, your significant other might not see a problem with carrying around debt, while you can’t even stand credit cards.

Some of these differences are more fundamental in nature and will require compromise. Others, though, are easily solved with candid discussions, established budgets, money management, and agreed-upon savings plans.

Then there are the couples who simply fight because of the stress that money can often cause. They use their significant other as a sounding board and, in some cases, a target for their frustration. This is often seen in households where finances are tight and the financial situation feels unstable, overwhelming, or even hopeless.

If this is the case in your marriage, you’ll need to do more than just talk about your personal finances: you’ll need to take action.

Mo’ Money Equals Less Problems?

If you won the lottery tomorrow, you might be surprised to find that your money problems wouldn’t just disappear. (In fact, you might find that you have a few new things to worry about.) However, there is something to be said for financial freedom, or at least having a little more wiggle room in your bank account.

Making more money, or simply spending less of what you already earn, can solve many money matters. Depending on your unique situation, this might mean that you can save more toward retirement, enjoy more vacations with your loved ones, or simply relax knowing you aren’t drowning in credit card debt.

No matter the breadth of your financial concern, more money does tend to lead to less worry.

“No matter the breadth of your financial concern, more money does tend to lead to less worry.”

The impact extends into your marriage, too. By reducing monthly household expenses, you and your significant other can enjoy added security and financial freedom. For you, this might mean setting new goals with your significant other and having the funds to dedicate to that goal each month. You might also enjoy earmarking those funds for a mutually-enjoyed activity, such as a couple’s hobby or even a vacation.

At its most basic level, reducing expenses each month has the ability to simply reduce conflict. And that alone has some serious value (pun intended).

Money can’t necessarily buy happiness, but it can resolve some of your stressors and, in turn, many problems. This is especially true if you and your significant other are regularly fighting about money.

How to Boost Your Personal Finances

There are many approaches you can take to improving your financial goals. Some are more comfortable than others and, depending on your personal factors, some might be less realistic.

Earning money outside of your 9 to 5 isn’t a new idea. However, the popularity of a “side hustle” has grown exponentially in recent years. By getting a second job on the side or turning a hobby into a money-maker, you can relieve some of the financial stress in your home.

You should also focus on setting a budget and sticking to it. This means sitting down with your spouse to determine your monthly spending habits, set goals, automate deposits to your savings account, and even eliminate expenses that are unnecessary or have a negative impact. In order for a good budget to work, of course, everyone has to be on the same page and commit to the plan.

If earning more money — in the form of a raise or even starting a side hustle — isn’t an option, you’ll have to simply spend less of what you already bring home in order to improve your financial issues.

One way to spend less each month without a dramatic shift in your family’s lifestyle is to look at reducing the existing expenses.

How Refinancing An Auto Loan Helps

If you are paying down on any installment debt, such as a financed auto loan, this can be a great place to cut costs and even free up your cash flow. You can consider a loan refinance, or refi, no matter how far you are into the loan’s repayment — and you can even refi your debt as many times as you want!

The right auto loan refinance can have multiple impacts on your financial situation. By refinancing your loan at a more competitive interest rate, you’ll decrease the amount you’ll pay on the loan overall. This means that more money stays in your checking account, or can be put toward paying off your mortgage, saving for retirement of the kids’ college, or taking that Caribbean trip your spouse has always wanted.

A refinanced auto loan can decrease your monthly payment. By doing so, you can improve your household finances. If money is tight and causing conflict in the home, lowering your monthly car payment with a refi could provide much-needed extra cash.

The good refi can also shorten the total length of your repayment. By raising your monthly repayments and/or lowering your interest rate, you can potentially pay off the balance owed sooner than planned. This means that you’ll be debt-free earlier, and can direct those funds toward something else your household needs.

Pick the right refi, and you can actually do all three at the same time.

How Impactful Is Car Loan Refinancing?

So, just how much can you save by refinancing your vehicle’s loan, and is it worth the trouble? The answers are almost always “a lot” and “Yes!”

According to our data here at RateGenius, the average borrower saves more than $1,100 over the course of their loan repayment, just by refinancing. That comes out to about $83 a month in savings. What could your family do with an extra $83 (or more) each and every month?

Saving Your Money and Marriage

It might seem a bit dramatic to say that refinancing your car loan can save your marriage. But in the end, it can definitely help.

Of course, a refi won’t do anything for your communication issues or the fact that someone always leaves wet towels on the bed — that part is on you. What refinancing can do is offer some flexibility to your household finances. Depending on the goals that you and your spouse set, and the money situation you’re currently in, the savings allowed from a refi can have serious impacts.

When you consider that money issues are the cause of divorce for almost a quarter of all married couples, it’s safe to say that reducing financial problems will also reduce your chances of splitting. And if you can save yourself some extra cash in the process? Well, that’s definitely worth making the leap.

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)