Federal rate cuts may present favorable options for auto refinance loan shoppers.

Updated on March 23, 2020:

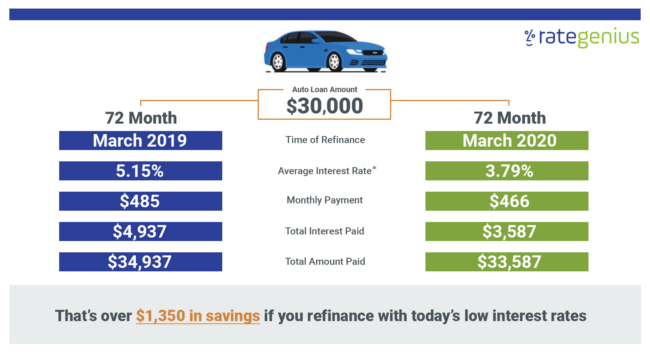

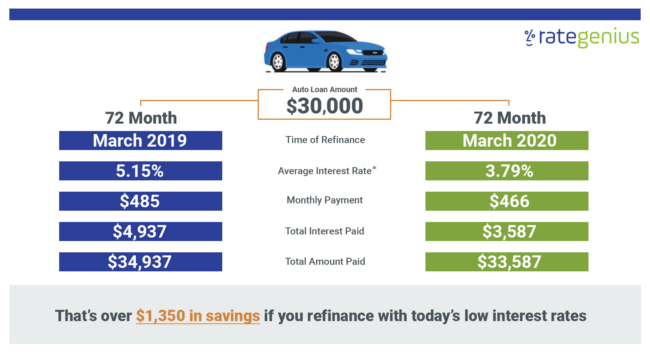

RateGenius has released analysis of March 2019 interest rates compared to March 2020, confirming that borrowers are starting to see the lowest auto refinance rates since 2015.

- Some lenders in our network have decreased rates by one full point, with a chance that rates may drop even more.

- Auto refinance applications have increased by 30% since the two federal rate cuts earlier in March.

- Prime borrowers –individuals with credit scores above 680 — could save an additional $1,350 in total interest paid on their auto loans by refinancing with today’s rates.

You can read the full report here.

Lenders are considering deferring payments on auto refinance loans to assist customers impacted by the pandemic. We will provide updates as more information becomes available.

RateGenius and lenders in our network are prepared to meet customer demand while also adhering to CDC guidelines to protect employees and the community. You can read RateGenius’ response to COVID-19 right here.

Updated on March 16, 2020: On Sunday, March 15, 2020, the Federal Reserve lowered rates a second time in less than two weeks, bringing rates down to nearly zero percent.

“The effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook. In light of these developments, the Committee decided to lower the target range for the federal funds rate to 0 to 1/4 percent,” The Federal Reserve said in their statement on Sunday. “The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

RateGenius is monitoring auto refinance loan rates across our lender network and will continue to provide analysis and updates as information becomes available.

Originally published on March 6, 2020:

On Tuesday, March 3rd, the Federal Reserve announced that it’s lowering its target federal funds rate by a half-percent in light of uncertainty in the economy brought on by the effects of the Coronavirus (COVID-19) outbreak across the globe.

The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 0.5 percentage point, to 1 to 1.25 percent. The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy.Federal Open Market Committee

This rare move means that the already-low federal funds rate will stay between 1% and 1.25%.

How Will Federal Rate Cuts Impact Auto Refinance Rates?

The target federal funds rate is what many banks and credit unions across the country look to when setting their own interest rates. These banks and credit unions will be adjusting their rates accordingly and will most likely affect auto refinance rates.

In a press conference, Federal Reserve Chairman Jerome Powell said of the emergency rate cuts, “We don’t think we have all the answers. But we do believe that our action will provide a meaningful boost to the economy… and it will help boost household and business confidence. That’s why you’re seeing central banks around the world responding as they see appropriate in their particular institutional context.”

Here at RateGenius, we’ve already seen some of our lender partners lower interest rates in response to the 0.5% federal rate cut. We expect to see more banks and credit unions to do the same.

Lower Your Monthly Car Payment by Refinancing

If you’re hoping to take advantage of the lower interest rates and save money on your monthly car payment, now is a great time to apply.

In order to qualify for an auto refinance loan with a competitive interest rate, lenders will be looking at your credit score, debt-to-income ratio, loan-to-value ratio, monthly income, and other factors. (Check out our guide to refinancing auto loans to learn about the process.)

Your vehicle will also need to qualify. While each lending institution has their own requirements, these are the minimum criteria for qualifying with a RateGenius lender.

;)