Did you get a subprime auto loan but want to get out of it? You may have options.

You needed a car, but your credit wasn’t in the best shape, so you got a loan with high-interest rates and exorbitant fees. It was fitting at the time because an expensive car loan seemed like a good idea and your only option.

Now, you want to know how to get out of a subprime auto loan. What steps can you take?

With the right information, you can decide the best way to get out of a subprime car loan for your situation, whether that’s paying it off early or refinancing.

What Is a Subprime Auto Loan?

A subprime car loan is an expensive loan option — sometimes the only loan option — for people with poor credit. These borrowers have credit scores in the subprime and deep subprime ranges, making them a “high risk” to extend credit to. To help offset the credit risk, subprime loans have three key features:

- High-interest rates

- Prepayment penalties

- Additional fees

Though it’s not always a fair assessment (there are many reasons why a responsible person could end up with a low credit score), many lenders aren’t comfortable lending to borrowers with lower credit scores. Bad credit worries lenders. There’s a higher chance of default, or not paying back the loan as agreed.

On the other hand, a low-risk individual, someone with good or excellent credit, is less likely to miss monthly payments on a car loan or stop paying it altogether. Lenders love low-risk borrowers, so they’ll offer these individuals better interest rates and loan terms.

One of the primary differences between subprime loans and traditional loans is the credit profile of the person applying for the loan: the subprime (and even deep subprime) borrower.

Experian considers a “fair” FICO score — between 580 and 669 — to be subprime. That means if you fall within this range, you’re likely a subprime borrower. However, financial institutions generally consider a score below 620 to be subprime.

Subprime car loan: a car loan for high-risk borrowers (those with poor credit or no credit) with high interest rates, prepayment penalties, and fees.

Prepayment penalty: a fee charged by your lender if you wipe out what you owe on your car loan before the end of the loan period.

Default: when a borrower fails to pay back the loan to the financial institution as agreed. If the loan goes into default, the lender can repossess the car and sell it.

How Does My Credit Impact What Kind of Car Loan I Get?

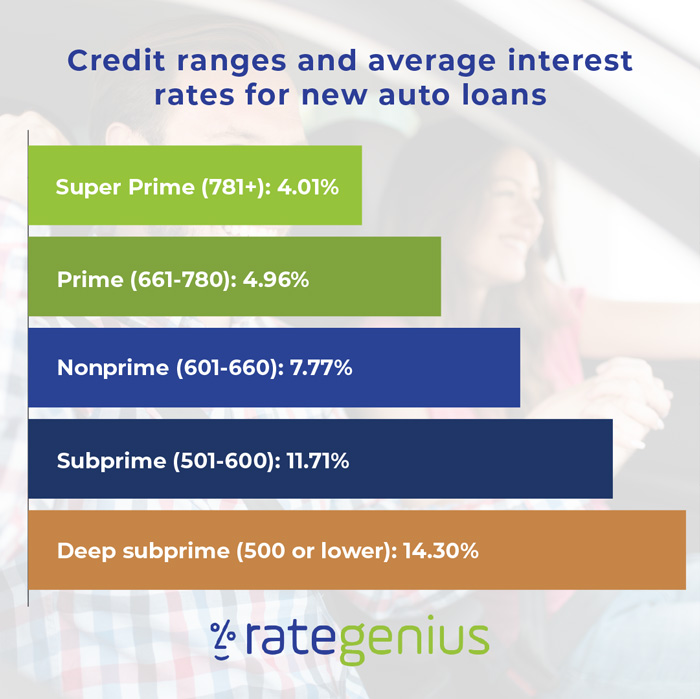

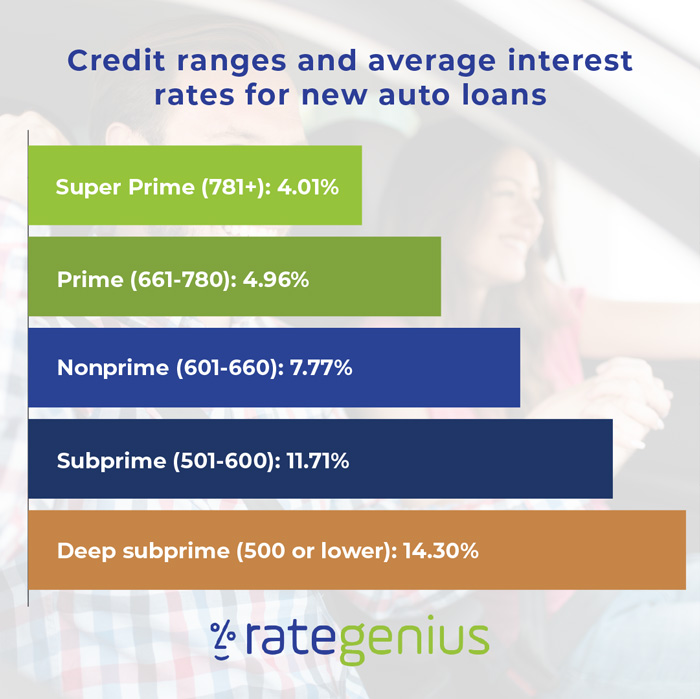

Lenders rank credit scores based on how well people manage their credit history. Auto lenders label credit scores differently than credit bureaus, though.

While every lender will have different credit score requirements, deep subprime borrowers can currently expect to pay 14.30% in interest for a new car loan. That is over three times the interest rate of someone with excellent credit.

Source: Experian “State of the Automotive Finance Market” Q3 2019

How Can I Tell If a Car Loan Is Subprime?

When you’re applying for car loans with bad credit, there usually isn’t a label on your loan that says “subprime.” That means you might not know what kind of deal you’re getting if you don’t have a fully transparent lender. You can spot a bad car loan by looking at these two features of loan terms:

- Interest rates: Traditional car loans will have interest rates that align with nonprime credit scores and above. If you notice that your interest rates are higher than the average, you might want to see if you qualify for other loan offers with more competitive interest rates.

- Loan fees: Other than interest rates, car loans often come with other fees. They might include documentation fees, prepayment penalties, and processing or returning payment fees. The best car loans won’t have prepayment penalties. The documentation fees will also be reasonable.

When you receive a loan offer, read the terms carefully. Your documents should include a complete breakdown of your costs — monthly payment, APR, total amount of interest, loan amount (including any upfront fees), and the sum of all payments — plus how long it will take you to pay it off. And any other fees or terms that apply to your loan and services.

Do people usually default on subprime car loans?

In general, subprime auto loans are loans for people that represent a higher credit risk. This means that they do have a higher risk of defaulting on their auto loan. That doesn’t mean all car loans for people with bad credit are in default. In the fourth quarter of 2018, subprime car loans had a delinquency rate of 8%. This means that only 8% of subprime loans are in default.

Getting a bad loan doesn’t mean you’re going to default and get behind on your payments. Even with higher interest rates, you can still manage your payments and keep your credit from taking a nosedive. Defaults happen because of life circumstances, not because of the type of loan you’re in. If you stay on top of your budget, you’ll have no trouble with a subprime loan.

Why Do Some Borrowers Choose a Subprime Auto Loan?

Qualifying for a traditional auto loan can be frustrating if you don’t meet the minimum credit requirements. Subprime auto loans allow people to get vehicles even when they don’t have the best credit. There are three components of qualifying for a car loan.

1. Credit history

Credit is the most common reason people go for a subprime car loan. If your FICO score is below 669, or if you have a limited credit history, you might have a hard time qualifying for traditional auto loans. Your credit history is one of the most important factors in determining whether you qualify for any auto loans. You want to keep it in good shape if you can.

Further reading on credit

2. Employment history

To qualify for a traditional auto loan, your lender will want to see steady, consistent income. If you are self-employed or receive income from non-traditional employment sources, you might need to apply for a subprime car loan. While they do require income in most cases, the terms of subprime auto lenders are more flexible than traditional car lenders.

3. Financial health

Even if you have taken great strides to improve your credit history or supplement your income, traditional auto lenders might still decline an application for financial reasons. If you have any unpaid tax liens, regardless of the reason, or if you have filed for bankruptcy in the past, this could limit your auto loan options.

Subprime auto loans can be expensive, but they are critical for some people to get access to the transportation they need. Most people need a subprime auto loan because they cannot qualify for a traditional car loan.

Why Should I Avoid Subprime Auto Loans?

Subprime loans aren’t just expensive — they come with other disadvantages. In addition to a greater chance of defaulting because of the higher monthly payments, subprime lenders sometimes engage in predatory lending practices like targeting low-income people. They also come with a higher chance of repossession if you miss a car payment or two.

The most unscrupulous subprime dealerships may even put ”kill switches” on your vehicle before you finalize the documents. This is why so many people want to know how to get out of a subprime auto loan.

These car loans also contribute to rising debt. If you are trying to reduce your debt or improve your credit, a subprime loan might have negative consequences.

Can I Get out From Under a Bad Car Loan?

The good news is that, even if you do have to settle for an expensive loan, it’s not hard to figure out how to get out of a subprime auto loan. You might qualify for a vehicle refinance, but you’ll want to take that approach carefully. The best approach is to start by improving your credit score so you can qualify for a traditional auto loan with lower rates.

The caveat to getting out from under a subprime auto loan is your vehicle’s value. If your vehicle is worth less than the loan balance, you’ll have a hard time finding a lender to refinance your vehicle. This is what people mean when they say you’re “upside down” in a loan. You might need to put money toward paying off your subprime loan before trying to get out from underneath it.

How to Get Out of a Subprime Auto Loan

So, you’re in a subprime auto loan and you don’t know what to do next. Do you keep making payments until you pay off the loan, or do you try to find a lender that will refinance your vehicle?

The truth is that it depends on your situation.

If you want to get your loan balance down so you can qualify for a vehicle refinance without being upside down, the best thing you can do is make additional payments toward your outstanding subprime auto loan. Once your balance is lower than the value of your vehicle, you might qualify for a vehicle refinance. You might also qualify to trade in your vehicle at a dealership for another one at this point.

If vehicle refinancing is your goal, the best thing you can do is work on improving your credit score. This means making on-time payments and keeping your account balances to a minimum. It also means you need to refrain from applying for new credit until you secure your new auto loan.

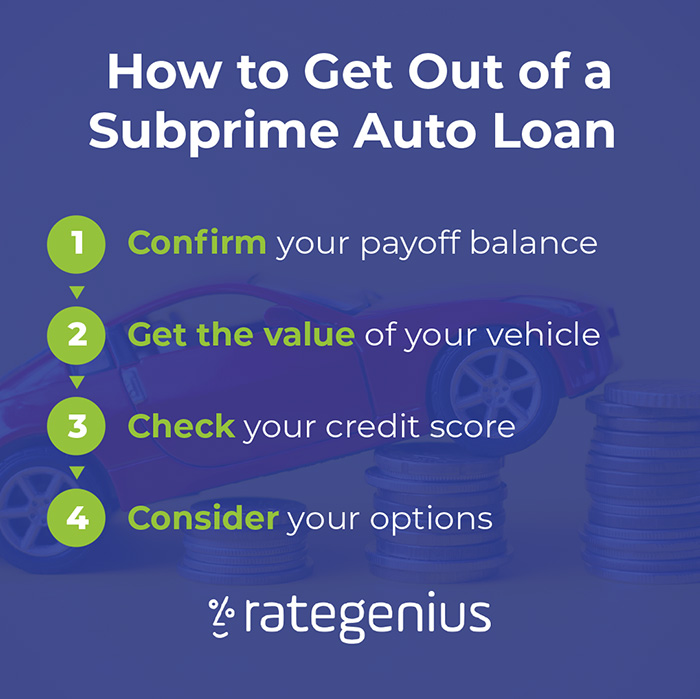

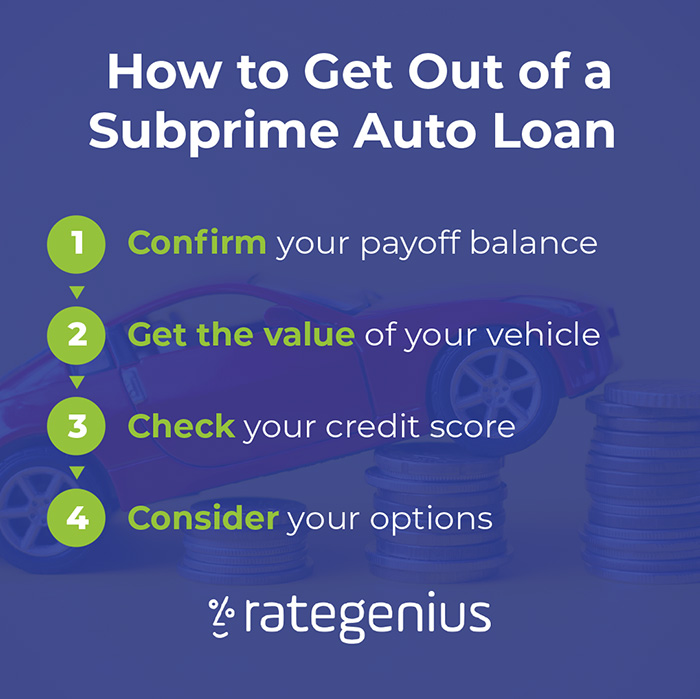

1. Confirm your payoff balance.

Whether you want to sell your vehicle, trade it in, or refinance it, you’ll need to know the exact payoff amount. You also need to know if there are any prepayment penalties for your loan. You can typically get this information from your account statement or an online portal or mobile app, if that’s available.

2. Get the value of your vehicle.

The value of your vehicle is critical to your loan amount. If you have negative equity in your vehicle, or is “upside down,” you’ll have a hard time selling or refinancing it. Dealerships and lenders have guidelines for your LTV ratio which can impact the offers you get.

3. Check your credit score.

If trading in or refinancing your vehicle is something you’re considering, it’s a good idea to find out what your credit score is. The higher your FICO score, the better your loan rates, even if you’re in a subprime loan. Review your free credit report to make sure it’s accurate, too.

4. Consider your options.

Refinancing your vehicle could potentially save you money, but if your credit is poor, you might not be able to get lower interest rates or payments. If your loan balance is low, you can consider trading it in or selling it to get out of the loan.

This is also a good time to think about your monthly budget. If a new vehicle or refinance is something you want, you’ll need to know how much you can afford to spend each month.

The Bottom Line About Bad Car Loans

Subprime auto loans may not be the cheapest option, but they are a tool for people who need access to a vehicle. You’re not stuck in one, though. If you manage your car payments and credit, you may have options for getting out of a bad car loan.

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)